tax avoidance vs tax evasion south africa

Tax avoidance understood as the use of the so-called loopholes in the tax legislation to reduce ones tax payments increasingly tops news charts. Tax avoidance entails maximizing the full amount of tax credit and tax deductions that a corporation can take Fuest and Schneider 2011.

Diuga highlights the difference between evasion planning and avoidance.

. Legal Aspects of Tax Avoidance and Tax Evasion Two general points can be made about tax avoidance and evasion. Tax Avoidance Differences between Tax Avoidance and Tax Evasion. Standard models of taxation and their conclusions.

It is reasonable to presume that anyone would want to pay less tax and therefore it is legal to implement ways in which to do so by use of mechanisms available under present laws and regulations. Tax Evasion is illegal. Diuga highlights the difference between evasion planning and avoidance.

Tax avoidance may be considered as either the amoral dodging of ones duties to society part of a strategy of not supporting violent government activities or just the right of every citizen to find all the legal ways to avoid paying too much tax. Other entities to avoid paying taxes in unlawful ways. Tax evasion often involves.

Usually this constitutes fraud ie falsifying statements or presenting false information to the South African Revenue Service SARS with penalties including imprisonment. Tax Avoidance vs Tax Evasion. But your business can avoid paying taxes and your tax preparer can help you do that.

Using unlawful methods to pay less or no tax. The taxman in order to decrease their tax burden and involves in specific false tax. Tax evasion on the other hand refers to efforts by people businesses trusts and.

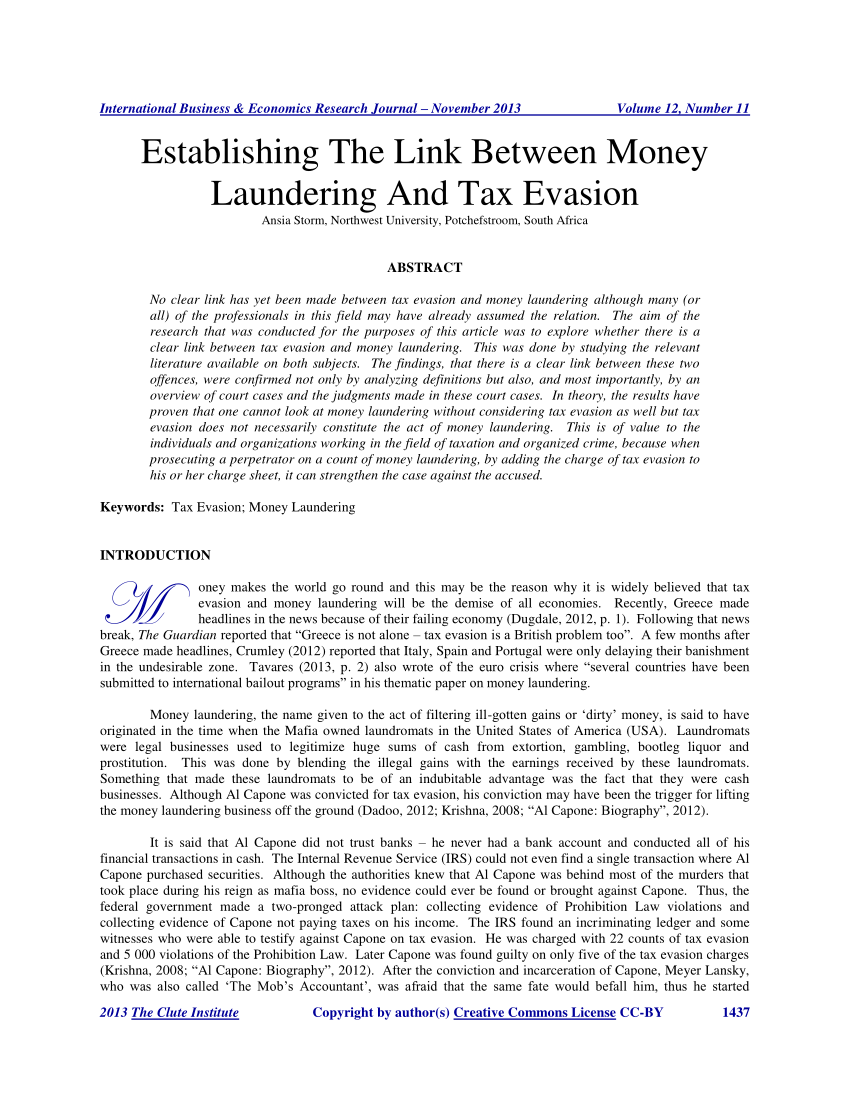

These two phenomena better captured by the concept of wage evasion than tax evasion concretely mean that south africa Tax avoidance is a complex concept that creates uncertainty in the south african tax law system and results in revenue loss. Secondly legislation that addresses avoidance or evasion must necessarily. The recent EUs blacklist of 17 tax havens Paradise Papers and last years Panama Papers are among the starkest examples.

Basically tax avoidance is legal while tax evasion is not. This paper first presents theoretical models that integrate avoidance and evasion into. Tax exemption for foreign employment income.

Tax Deductions PAYE on your Pension or Annuity. Usually this constitutes fraud ie falsifying statements or presenting false information to the South African Revenue Service SARS with penalties including imprisonment. Businesses get into trouble with the IRS when they intentionally evade taxes.

View Tax evasion vs tax avoidance in South Africa and why SARS wants you to pay your fair sharepdf from FIN FINANCIAL at University of South. Tax filing season starts on 01 July. Measures improving the ability to enforce tax laws 26 521.

Tax avoidance vs tax evasion south africa. The south african situation 8 4. First tax avoidance or evasion occurs across the tax spectrum and is not peculiar to any tax type such as import taxes stamp duties VAT PAYE and income tax.

Taxpayers intentionally falsifying or concealing the true condition of their activities to. Must reflect these realities. Addressing weak enforcement at the.

Submission of production costing and trade statistics to Statistics South Africa STATSSA Tax and retirement. Using unlawful methods to pay less or no tax. Tax Avoidance is legal.

Diuga highlights the difference between evasion planning and avoidance. Apr 04 2022 Understanding the difference between tax evasion and tax avoidance is critical because it can mean the difference between paying low taxes and going to prison Yoon 2014. Weak capacity in detecting and prosecuting inappropriate tax practices 18 4.

Tax Avoidance vs Tax Evasion Infographic. Recent waves of tax dodging scandals including those of tax. SOUTH AFRICATax evasion vs tax avoidance in South Africa and why SARS wants you to pay your fair share 15 September 2021 News 174 Fares RAHAHLIA There is not so much of a fine line between tax evasion and tax planning as there is a giant grey superhighway dissecting the two named tax avoidance says Mark Diuga regional wealth.

The overall decision problem faced by individuals. Undoubtedly skewed by this reality. Usually this constitutes fraud ie falsifying statements or presenting false information to the South African Revenue Service SARS with penalties including imprisonment.

Classifying a transaction as an impermissible tax avoidance arrangement does not automatically equate to tax evasion. Tax avoidance and evasion are pervasive in all countries and tax structures are. Race Institutional Culture and Transformation at South African Higher Education Institutions South African Constitutional Law in Context Współczesna endodoncja w praktyce.

Tax avoidance is generally the legal exploitation of the tax regime to ones own advantage to attempt to reduce the amount of tax that is payable by means that are within the law whilst making a full disclosure of the material information to the tax authorities. For someone to be found guilty of tax evasion there must have been an unlawful intention to wilfully deceive SARS by means of fraud or deceit either by misstating figures or entering into simulated sham transactions. Strategies against tax evasion and tax avoidance 25 51.

The terms tax avoidance and tax evasion are often used interchangeably but they are very different concepts. Tax evasion on the other hand is a crime in almost all countries and subjects the guilty party. Measures improving tax compliance 25 52.

Modes of tax evasion and avoidance in developing countries 19 5. The principle of evading payment of taxes by use of illegal means is to be frowned. De Vos the difference between tax avoidance and tax evasion tax january 30 2015 admin tax avoidance is generally the legal exploitation of the tax regime to.

Using unlawful methods to pay less or no tax.

Top 5 Tax Scandals World Finance

Pdf Tax Evasion Tax Avoidance And Tax Expenditures In Developing Countries A Review Of The Literature Semantic Scholar

Pdf Establishing The Link Between Money Laundering And Tax Evasion

Pdf The Effect Of Tax Avoidance On Cost Of Debt Capital Evidence From Korea1

Difference Between Tax Avoidance And Tax Evasion Youtube

Pdf Tax Evasion Tax Avoidance And Tax Expenditures In Developing Countries A Review Of The Literature Semantic Scholar

Basic Notes On Tax Avoidance And Tax Evasion Tax Evasion And Tax Avoidance General Principles Studocu

The Threeory Of Tax Actions Evasion Vs Avoidance Vs Planning Temple Group Mauritius

Ikea S Ownership Structure Source Figure Adapted From Administration Download Scientific Diagram

Difference Between Tax Avoidance And Tax Evasion Youtube

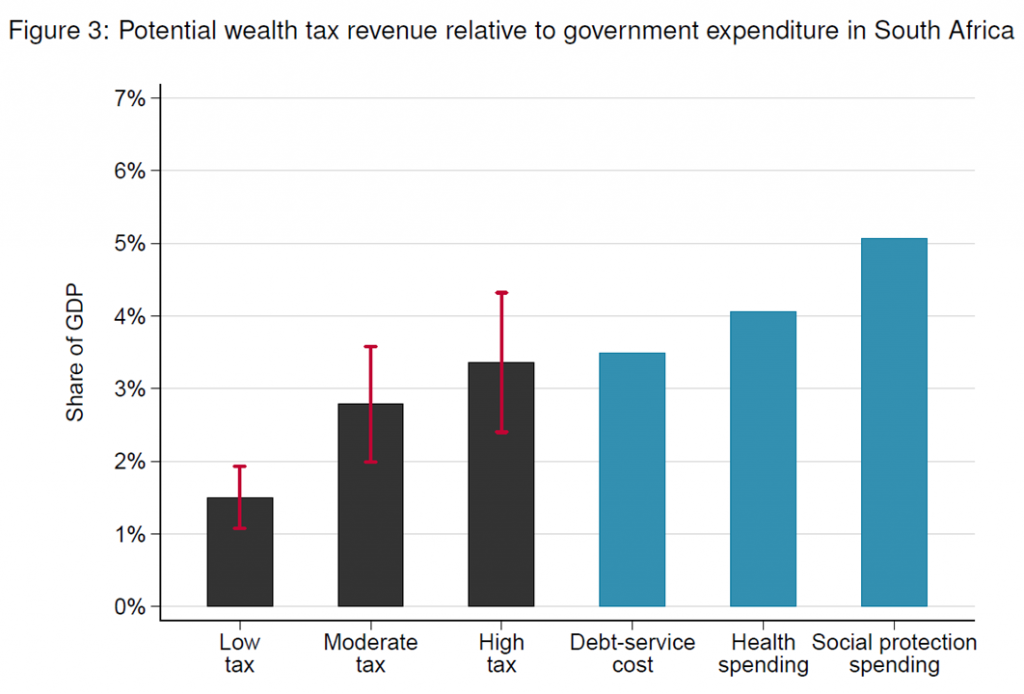

A Wealth Tax For South Africa Wid World Inequality Database

Pdf Tax Compliance And Behavioural Response In South Africa An Alternative Investigation

Pdf Tax Evasion Tax Avoidance And Tax Expenditures In Developing Countries A Review Of The Literature Semantic Scholar

Pdf Gender And Public Attitudes Toward Corruption And Tax Evasion

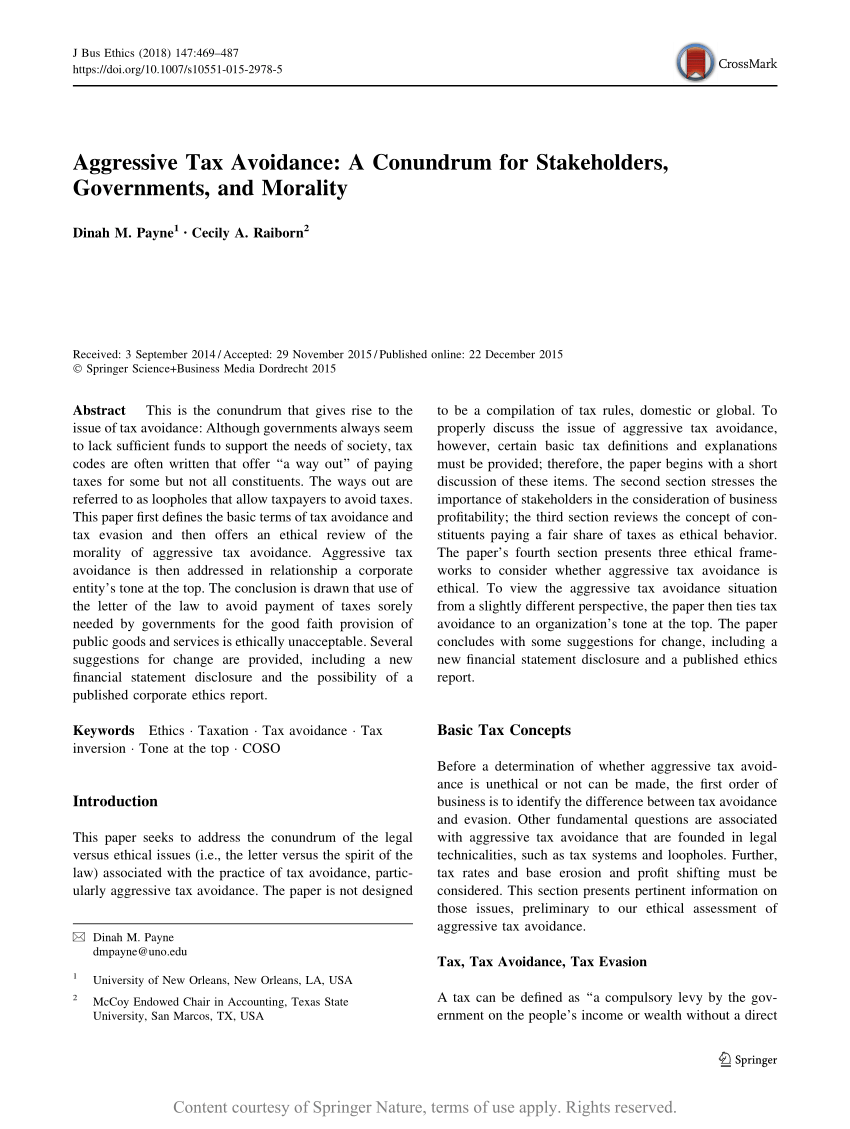

Aggressive Tax Avoidance A Conundrum For Stakeholders Governments And Morality Request Pdf

Free Pdf Towards Improving South Africa S Legislation On Tax Evasion A Comparison Of Legislation On Tax Evasion Of The Usa Uk Australia And South Africa Ansia Storm Academia Edu

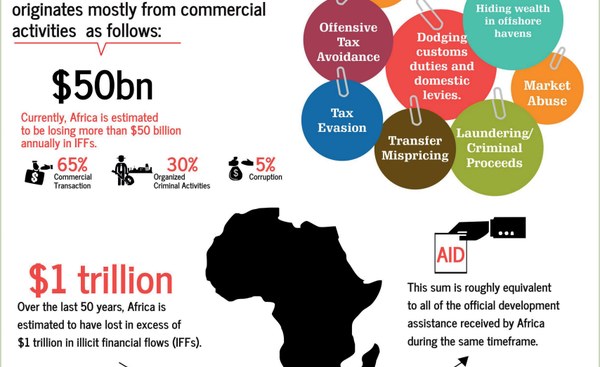

Africa Un Must Fight Tax Evasion Says Un Expert Allafrica Com

Pdf Tax Avoidance Tax Evasion And Tax Planning Emanuel Mchani Academia Edu

Pdf Tax Evasion Tax Avoidance And Tax Expenditures In Developing Countries A Review Of The Literature Semantic Scholar